Understanding Leverage in Forex Trading

In the world of forex trading, forex trading what is leverage Trading Brokers in Bangladesh serve as a crucial resource for traders seeking to enhance their trading experience. One of the most fundamental concepts that traders must grasp is leverage. It plays a significant role in determining how much capital you can control in the market, ultimately affecting your potential profits and losses. In this article, we will delve into what leverage is, how it operates in the forex market, and the implications it has for traders of all levels.

What is Leverage?

Leverage in forex trading refers to the ability to control a larger position than the amount of capital you have in your trading account. Essentially, it allows traders to borrow money from their broker to increase their exposure to the market. Leverage is expressed as a ratio, such as 1:100, which means that for every $1 in your account, you can control $100 in the forex market.

How Does Leverage Work?

When you open a leveraged position, your broker provides you with the additional funds needed to increase your trading volume. For example, if you have a $1,000 account and use a leverage ratio of 1:100, you can trade up to $100,000 worth of currency pairs. This means that even small price movements in the currency market can lead to significant gains or losses.

Calculating Leverage

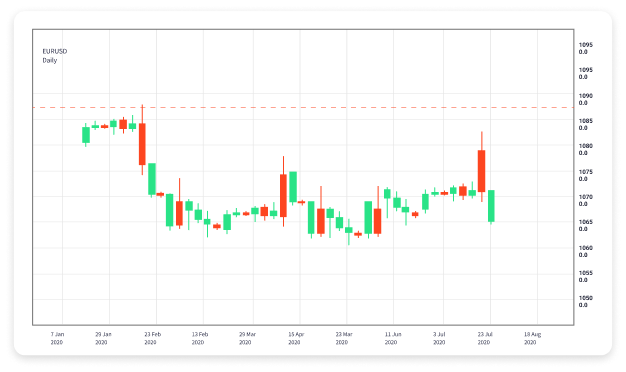

To understand how leverage works in practice, let’s consider a practical example. Suppose you decide to trade the EUR/USD currency pair. If you buy one standard lot (100,000 units) of EUR/USD at a price of 1.1200, this translates to a total trade value of $112,000. Using a leverage of 1:100, you would only need to put down $1,120 of your own capital. Should the market move in your favor by just 1%, you would gain $1,120. Conversely, if it moves against you by 1%, you would incur a loss of the same amount.

Advantages of Leverage in Forex Trading

Leverage can offer several advantages to traders, including:

- Increased Profit Potential: The most significant benefit of leverage is the ability to amplify profits. A small amount of capital can control a much larger position, which means that traders can make substantial gains from minor price movements.

- Accessibility: Forex trading with leverage allows individuals to participate in the market without needing a large amount of capital upfront. This accessibility enables many people to enter the forex market and take part in trading activities.

- Flexibility: Leverage offers traders flexibility in their trading strategies. Depending on their risk appetite and market conditions, traders can choose to use varying levels of leverage to suit their objectives.

Risks of Using Leverage

While leverage presents opportunities for increased profits, it also carries significant risks:

- Amplified Losses: Just as leverage can magnify profits, it can also magnify losses. With higher leverage, a small adverse movement in the market can wipe out your trading capital rapidly.

- Margin Calls: If your account balance falls below a certain level due to losses, your broker may issue a margin call, requiring you to deposit more funds into your account or close positions to cover the losses.

- Emotional Stress: The higher the leverage, the more emotional stress a trader can experience. The pressure of managing larger positions can lead to impulsive decisions and potentially poor trading outcomes.

Best Practices for Using Leverage

To mitigate the risks associated with leverage while maximizing its benefits, traders should adopt prudent practices:

- Understand the Market: Before using leverage, ensure you have a solid understanding of market dynamics. Knowledge of economic indicators, geopolitical events, and technical analysis can help inform better trading decisions.

- Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses. This strategy automatically closes your position when the market reaches a certain unfavorable price, helping to safeguard your capital.

- Limit Leverage: Avoid excessive leverage. It may be tempting to use the maximum available leverage, but a more conservative approach can provide greater protection against market fluctuations.

- Practice with a Demo Account: Before trading with real funds, practice your strategies with a demo account. This will allow you to experience leverage in a low-risk environment and develop your trading skills.

Conclusion

In summary, leverage is a powerful tool in forex trading that can significantly impact a trader’s potential profits and losses. By understanding how leverage works, recognizing its advantages and risks, and implementing sound trading practices, traders can navigate the forex market with more confidence. Whether you are a beginner or an experienced trader, being aware of how to use leverage responsibly can lead to a more successful trading journey in the world of forex. Always remember that while leverage increases your opportunities, it equally amplifies your risks, so make informed decisions to protect your trading capital.